The Role of Patience in Successful Investing

Understanding Patience as an Investment Strategy

Patience is often overlooked in the fast-paced world of investing, yet it is one of the most critical components of long-term success. Unlike day trading or speculative ventures, patient investing involves a commitment to holding assets over extended periods, allowing them to grow in value naturally. This approach requires a deep understanding of market cycles, the ability to resist emotional decision-making, and a focus on fundamental analysis rather than short-term trends. By prioritizing patience, investors can avoid the pitfalls of impulsive actions and capitalize on the power of compounding returns.

The Psychology of Patience in Market Volatility

Market volatility is an inevitable part of investing, and how investors respond to it can make or break their portfolios. Patience plays a crucial role in navigating these fluctuations. When markets dip, impulsive investors may panic and sell at a loss, while patient investors recognize these moments as opportunities to buy quality assets at discounted prices. Cultivating patience involves managing emotions, staying informed, and maintaining a long-term perspective. By understanding the psychological aspects of investing, individuals can develop the resilience needed to withstand market turbulence and emerge stronger.

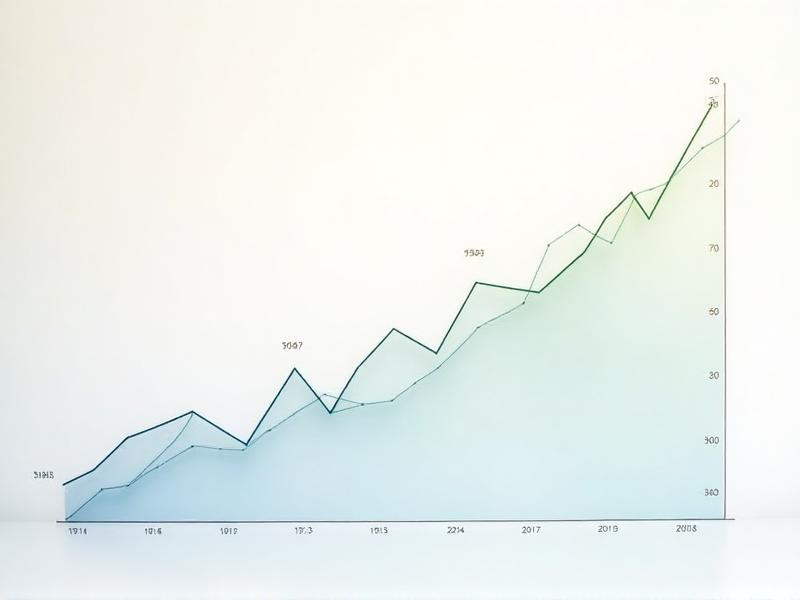

Patience and Compound Interest: The Power of Time

One of the most compelling reasons to practice patience in investing is the power of compound interest. Compound interest allows earnings to generate additional earnings over time, creating exponential growth. The longer an investment is held, the greater the potential for compounding to work its magic. For example, a modest initial investment can grow significantly over decades, provided it is left untouched. This principle underscores the importance of starting early and staying committed to a long-term strategy. Patience, in this context, is not just a virtue but a financial necessity.

Case Studies: Successful Investors Who Embraced Patience

History is replete with examples of investors who achieved remarkable success by exercising patience. Warren Buffett, often referred to as the "Oracle of Omaha," is a prime example. His investment philosophy revolves around buying and holding high-quality companies for the long term, regardless of short-term market fluctuations. Similarly, John Bogle, the founder of Vanguard, advocated for low-cost index funds and a patient, buy-and-hold approach. These case studies highlight how patience, combined with sound investment principles, can lead to extraordinary outcomes. By studying their strategies, investors can gain valuable insights into the role of patience in building wealth.

Common Mistakes Impatient Investors Make

Impatience in investing often leads to costly mistakes. One common error is chasing "hot" stocks or trends without conducting proper research. This can result in buying at inflated prices and selling at a loss when the hype fades. Another mistake is overtrading, which increases transaction costs and reduces overall returns. Additionally, impatient investors may abandon their strategies during market downturns, missing out on potential recoveries. By recognizing these pitfalls, investors can take steps to cultivate patience and avoid behaviors that undermine their financial goals.

Practical Tips for Cultivating Patience in Investing

Developing patience as an investor is a skill that can be honed with practice. One effective strategy is to set clear, long-term goals and regularly review them to stay focused. Diversifying a portfolio can also reduce the temptation to make impulsive decisions, as it spreads risk across different assets. Additionally, staying informed and educated about the markets can build confidence and reduce anxiety. Finally, working with a financial advisor can provide guidance and accountability, helping investors stick to their strategies even during challenging times. Patience is not just about waiting; it’s about making deliberate, informed choices that align with long-term objectives.

The Long-Term Rewards of Patient Investing

While the benefits of patience in investing may not be immediately apparent, they become undeniable over time. Patient investors are more likely to achieve steady, sustainable growth, avoid unnecessary risks, and build wealth that lasts. This approach fosters financial security and peace of mind, allowing individuals to focus on their broader life goals. In a world that often prioritizes instant gratification, patience in investing stands out as a timeless and effective strategy. By embracing this mindset, investors can unlock the full potential of their financial journeys.