Why Infrastructure Funds Are a Smart Investment Choice

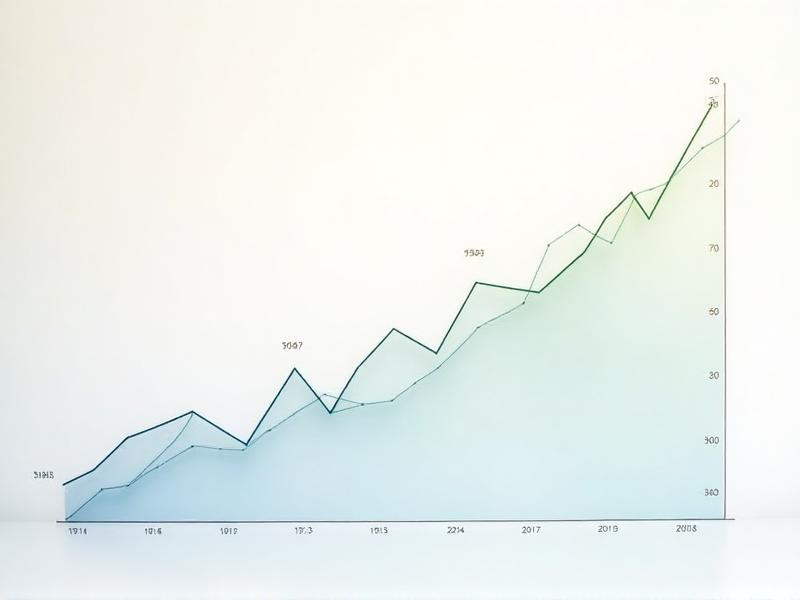

Infrastructure funds have emerged as a compelling investment option for those seeking stable returns and long-term growth. These funds focus on essential assets like roads, bridges, utilities, and telecommunications networks, which are critical to the functioning of modern societies. Unlike more volatile sectors, infrastructure investments often provide steady cash flows and are less susceptible to economic downturns. This makes them an attractive choice for investors looking to diversify their portfolios and mitigate risk.

One of the key reasons infrastructure funds are gaining popularity is their ability to generate consistent returns. Many infrastructure projects are backed by government contracts or long-term agreements, ensuring a predictable revenue stream. Additionally, the demand for infrastructure is inelastic, meaning it remains relatively stable regardless of economic conditions. This stability is particularly appealing in uncertain times, offering a safe haven for capital.

The Role of Infrastructure in Economic Growth

Infrastructure plays a pivotal role in driving economic growth and development. Efficient transportation networks, reliable energy supplies, and advanced communication systems are the backbone of any thriving economy. By investing in infrastructure funds, investors indirectly contribute to the development of these essential assets, which in turn fosters economic progress.

Moreover, infrastructure investments often have a multiplier effect on the economy. For instance, building a new highway not only improves transportation but also creates jobs, boosts local businesses, and attracts further investment. This ripple effect can lead to sustained economic growth, making infrastructure funds a win-win for both investors and society at large.

Diversification Benefits of Infrastructure Funds

Diversification is a cornerstone of sound investment strategy, and infrastructure funds offer an excellent way to achieve it. These funds typically invest in a wide range of assets across different sectors and geographies, reducing the risk associated with any single investment. This diversification helps protect against market volatility and economic fluctuations, providing a more stable and resilient portfolio.

Furthermore, infrastructure assets often have low correlation with traditional asset classes like stocks and bonds. This means that even when the stock market is performing poorly, infrastructure investments may still generate positive returns. By adding infrastructure funds to their portfolios, investors can achieve a more balanced and risk-adjusted return profile.

Long-Term Stability and Inflation Protection

Infrastructure funds are particularly well-suited for long-term investors seeking stability and protection against inflation. Many infrastructure projects have long lifespans and generate steady cash flows over decades. This long-term focus aligns well with the goals of retirement planning or other future-oriented financial strategies.

In addition, infrastructure investments often include inflation-linked contracts, which adjust revenues based on inflation rates. This provides a natural hedge against rising prices, ensuring that the real value of returns is preserved. For investors concerned about the eroding effects of inflation, infrastructure funds offer a reliable solution.

Environmental and Social Impact of Infrastructure Investments

Investing in infrastructure funds can also have a positive impact on the environment and society. Many modern infrastructure projects focus on sustainability, such as renewable energy plants, green buildings, and efficient public transportation systems. By supporting these initiatives, investors contribute to the global transition to a more sustainable and eco-friendly future.

Moreover, infrastructure investments often improve the quality of life for communities by providing essential services like clean water, reliable electricity, and accessible healthcare facilities. This social impact adds an ethical dimension to investing, allowing investors to align their financial goals with their values.

Risks and Considerations in Infrastructure Investing

While infrastructure funds offer numerous benefits, it's important to be aware of the potential risks and challenges. Regulatory changes, construction delays, and political instability can all impact the performance of infrastructure investments. Investors should carefully assess these factors and consider working with experienced fund managers who can navigate these complexities.

Additionally, infrastructure projects often require significant upfront capital and have long payback periods. This illiquidity can be a drawback for investors who need quick access to their funds. However, for those with a long-term investment horizon, the benefits of infrastructure funds can outweigh these risks.

How to Get Started with Infrastructure Funds

For those interested in exploring infrastructure funds, the first step is to research and identify reputable fund managers with a strong track record. Look for funds that align with your investment goals, risk tolerance, and time horizon. It's also advisable to diversify within the infrastructure sector by investing in funds that cover different types of assets and regions.

Consulting with a financial advisor can provide valuable insights and help tailor an investment strategy that meets your specific needs. With careful planning and due diligence, infrastructure funds can be a rewarding addition to your investment portfolio, offering stability, growth, and positive impact.