Understanding IPOs: A Primer for Investors

An Initial Public Offering (IPO) marks the transition of a private company into a publicly traded entity. For investors, this event represents an opportunity to buy shares in a company during its early stages of public trading. IPOs are often associated with high-growth companies, particularly in technology and innovation sectors, but they can span various industries. Understanding the mechanics of an IPO is crucial for any investor considering this avenue. Companies typically go public to raise capital, increase visibility, and provide liquidity for early investors. However, the process is complex, involving regulatory compliance, underwriting, and market timing. For investors, IPOs can offer the chance to get in on the ground floor of a potentially lucrative investment, but they also come with risks, including volatility and uncertainty about the company’s future performance.

The Allure of IPOs: Potential Rewards

Investing in IPOs can be highly attractive for several reasons. First, there’s the potential for significant capital gains. Early investors in companies like Amazon, Google, or Facebook reaped enormous rewards as these companies grew into industry giants. IPOs often generate buzz and media attention, which can drive up stock prices in the short term. Additionally, IPOs provide access to innovative companies that may not yet be available on the public market. For investors seeking diversification, IPOs can offer exposure to new sectors or emerging markets. Another advantage is the opportunity to support and invest in companies that align with personal values or interests, such as sustainability or technological innovation. However, while the rewards can be substantial, they are not guaranteed, and investors must carefully evaluate each opportunity.

The Risks of Investing in IPOs

While IPOs can be rewarding, they are not without risks. One of the primary concerns is the lack of historical data. Unlike established public companies, newly listed firms often have limited financial track records, making it difficult to assess their long-term viability. Additionally, IPOs can be highly volatile, with stock prices subject to dramatic fluctuations in the early days of trading. Another risk is the potential for overvaluation. Companies and underwriters may set IPO prices higher than the company’s actual value, leading to a price correction post-listing. Furthermore, lock-up periods—where early investors and insiders are restricted from selling their shares—can lead to a sudden influx of shares on the market, depressing prices. For retail investors, there’s also the challenge of accessing IPO shares, which are often allocated to institutional investors first.

Evaluating IPO Opportunities: Key Factors to Consider

When considering an IPO investment, thorough research is essential. Start by examining the company’s prospectus, a document that provides detailed information about its financials, business model, and risks. Look for companies with strong fundamentals, such as consistent revenue growth, a competitive advantage, and a clear path to profitability. It’s also important to assess the management team’s experience and track record. Industry trends and market conditions can significantly impact an IPO’s success, so consider the broader economic environment. Additionally, evaluate the company’s valuation compared to its peers. Overvalued IPOs may not perform well in the long term. Finally, consider your own investment goals and risk tolerance. IPOs can be exciting, but they should align with your overall financial strategy.

The Role of Underwriters in IPOs

Underwriters play a critical role in the IPO process, acting as intermediaries between the company and the public market. Investment banks and financial institutions underwrite IPOs by purchasing shares from the company and selling them to investors. They help determine the IPO price, structure the offering, and ensure regulatory compliance. Underwriters also provide marketing and distribution support, generating interest among potential investors. While underwriters aim to set a fair price, their interests may not always align with those of retail investors. For example, underwriters may prioritize institutional clients, leaving fewer shares available for individual investors. Understanding the role of underwriters can help investors navigate the IPO landscape more effectively.

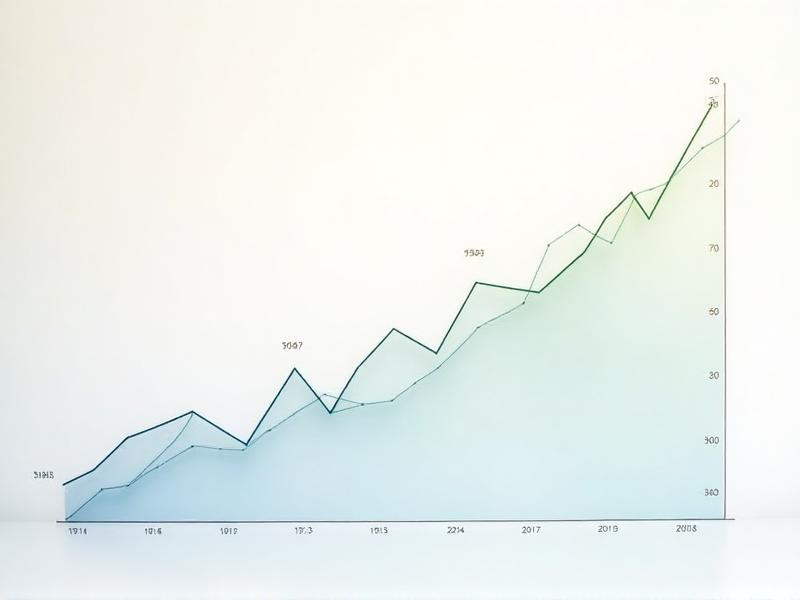

Historical Performance of IPOs: What the Data Shows

Historical data on IPOs reveals mixed results. While some IPOs have delivered exceptional returns, others have underperformed or even failed. Studies show that many IPOs experience a “pop” on their first day of trading, followed by a period of volatility. Over the long term, the performance of IPOs tends to vary widely depending on the company’s fundamentals and market conditions. For example, tech IPOs have historically been more volatile but also offered higher potential returns. It’s important to note that past performance is not indicative of future results, and each IPO should be evaluated on its own merits. Investors should approach IPOs with a balanced perspective, recognizing both the opportunities and risks.

Strategies for Investing in IPOs

Developing a sound strategy is key to navigating the IPO market successfully. One approach is to focus on companies with strong fundamentals and a clear competitive edge. Diversification is also important—spreading investments across multiple IPOs can help mitigate risk. Another strategy is to wait for the initial hype to subside before investing, allowing the stock price to stabilize. Some investors prefer to invest in IPO-focused mutual funds or ETFs, which provide exposure to a basket of newly listed companies. Additionally, staying informed about market trends and regulatory changes can help investors make more informed decisions. Ultimately, a disciplined and research-driven approach is essential for success in the IPO market.

Conclusion: Weighing the Pros and Cons of IPO Investing

Investing in IPOs offers a unique blend of opportunities and challenges. On one hand, IPOs provide access to innovative companies and the potential for significant returns. On the other hand, they come with risks, including volatility, overvaluation, and limited historical data. For investors, the key to success lies in thorough research, careful evaluation, and a disciplined approach. While IPOs can be exciting, they should be viewed as part of a broader investment strategy rather than a standalone opportunity. By understanding the pros and cons of IPO investing, investors can make more informed decisions and navigate this complex market with greater confidence.