Understanding Index Funds: The Basics

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to track the performance of a specific market index, such as the S&P 500 or the NASDAQ. Unlike actively managed funds, where a fund manager selects individual stocks, index funds aim to replicate the performance of the index they follow. This passive management approach often results in lower fees and expenses, making index funds an attractive option for long-term investors.

One of the key advantages of index funds is their simplicity. By investing in an index fund, you gain exposure to a broad range of companies or assets within a single investment. This diversification helps reduce risk, as the performance of the fund is not dependent on the success of a single company. Additionally, index funds are known for their consistent performance over time, often outperforming actively managed funds.

When considering index funds, it's important to understand the difference between mutual funds and ETFs. Mutual funds are typically bought and sold at the end of the trading day at the fund's net asset value (NAV), while ETFs can be traded throughout the day like stocks. Both options have their pros and cons, and the choice depends on your investment strategy and preferences.

Why Index Funds Are Ideal for Long-Term Growth

Index funds are particularly well-suited for long-term growth due to their low costs, diversification, and historical performance. Over time, the compounding effect of reinvested dividends and capital gains can significantly enhance the value of your investment. Since index funds have lower expense ratios compared to actively managed funds, more of your money is invested in the market, allowing you to benefit from long-term growth.

Another reason index funds are ideal for long-term growth is their ability to weather market volatility. While no investment is entirely risk-free, the broad diversification of index funds helps mitigate the impact of individual stock fluctuations. This stability is crucial for long-term investors who aim to build wealth gradually over decades rather than seeking quick gains.

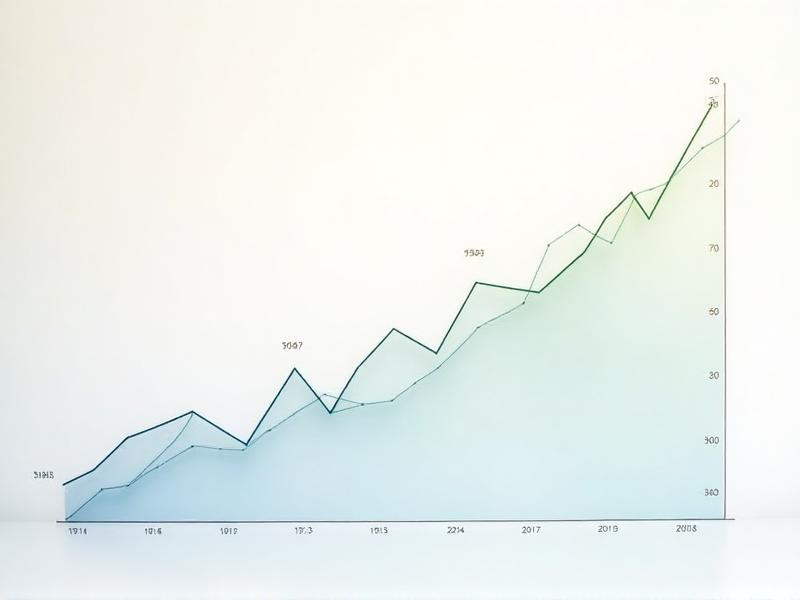

Historical data supports the case for index funds as a long-term investment strategy. Studies have shown that a significant percentage of actively managed funds fail to outperform their benchmark indices over the long term. By investing in index funds, you are essentially betting on the overall growth of the market, which has historically trended upward over extended periods.

How to Choose the Right Index Fund for Your Portfolio

Selecting the right index fund involves considering several factors, including the index it tracks, the fund's expense ratio, and its performance history. The first step is to determine which index aligns with your investment goals. For example, if you are looking for broad market exposure, an S&P 500 index fund might be appropriate. If you prefer exposure to technology stocks, a NASDAQ index fund could be a better fit.

The expense ratio is another critical factor to consider. This is the annual fee that the fund charges as a percentage of your investment. Lower expense ratios mean more of your money is working for you in the market. It's also important to review the fund's performance history, although past performance is not a guarantee of future results, it can provide insight into how the fund has fared in different market conditions.

Additionally, consider the fund's size and liquidity. Larger funds with higher assets under management (AUM) tend to be more stable and have lower trading costs. Liquidity is also important, especially for ETFs, as it affects how easily you can buy or sell shares without significantly impacting the price.

The Role of Diversification in Index Fund Investing

Diversification is a fundamental principle of investing that involves spreading your investments across various asset classes, sectors, and geographies to reduce risk. Index funds inherently provide diversification because they track a broad index composed of many different stocks or bonds. This means that even if one or a few companies in the index perform poorly, the overall impact on your investment is minimized.

When building a diversified portfolio with index funds, consider including funds that cover different sectors, such as technology, healthcare, and consumer goods, as well as funds that invest in different geographic regions, such as U.S., international, and emerging markets. This approach helps ensure that your portfolio is not overly concentrated in any one area, reducing the potential for significant losses.

It's also important to periodically review and rebalance your portfolio to maintain your desired level of diversification. Over time, some investments may grow faster than others, causing your portfolio to become unbalanced. Rebalancing involves selling some investments and buying others to bring your portfolio back in line with your target allocation.

Strategies for Investing in Index Funds Over Time

Investing in index funds over time requires a disciplined approach and a long-term perspective. One effective strategy is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility by spreading your investments over time, potentially lowering your average cost per share.

Another strategy is to reinvest dividends and capital gains. Many index funds offer the option to automatically reinvest these earnings, allowing you to take advantage of compounding. Over time, reinvesting dividends can significantly enhance the growth of your investment, as you earn returns not only on your initial investment but also on the reinvested earnings.

It's also important to stay committed to your investment plan, even during market downturns. While it can be tempting to sell during periods of volatility, staying the course and continuing to invest can lead to better long-term results. Remember that market downturns are a normal part of the investment cycle, and history has shown that markets tend to recover and grow over time.

Common Mistakes to Avoid When Investing in Index Funds

While index funds are a relatively straightforward investment option, there are some common mistakes that investors should avoid. One mistake is chasing performance. Just because an index fund has performed well in the past does not guarantee future success. It's important to focus on the fund's underlying index, expense ratio, and diversification rather than past performance alone.

Another mistake is failing to diversify adequately. While index funds provide diversification within a specific index, it's important to ensure that your overall portfolio is well-diversified across different asset classes, sectors, and geographies. Overconcentration in any one area can increase risk and reduce the potential for long-term growth.

Lastly, some investors make the mistake of trying to time the market. Attempting to buy low and sell high is difficult even for experienced investors and can lead to missed opportunities and higher transaction costs. Instead, focus on a long-term investment strategy and stay committed to your plan, regardless of short-term market fluctuations.

Monitoring and Rebalancing Your Index Fund Portfolio

Monitoring your index fund portfolio is an essential part of long-term investing. Regularly reviewing your investments helps ensure that your portfolio remains aligned with your financial goals and risk tolerance. This involves checking the performance of your funds, assessing your asset allocation, and making adjustments as needed.

Rebalancing is a key aspect of portfolio management. Over time, some investments may grow faster than others, causing your portfolio to deviate from your target allocation. Rebalancing involves selling some investments and buying others to bring your portfolio back in line with your desired allocation. This process helps maintain the appropriate level of risk and can enhance long-term returns.

It's also important to consider tax implications when rebalancing. Selling investments can trigger capital gains taxes, so it's wise to consult with a tax advisor or financial planner to develop a tax-efficient rebalancing strategy. Additionally, consider using tax-advantaged accounts, such as IRAs or 401(k)s, to minimize the tax impact of your investments.

The Future of Index Fund Investing: Trends and Predictions

The popularity of index funds has grown significantly in recent years, and this trend is expected to continue. One emerging trend is the rise of ESG (Environmental, Social, and Governance) index funds, which focus on companies that meet specific sustainability criteria. As more investors prioritize socially responsible investing, ESG index funds are likely to gain traction.

Another trend is the increasing use of technology in index fund investing. Advances in artificial intelligence and machine learning are enabling more sophisticated portfolio management and risk assessment. These technologies can help investors make more informed decisions and optimize their investment strategies.

Looking ahead, the low-cost, passive investment approach of index funds is expected to remain attractive to investors. As the financial industry continues to evolve, index funds are likely to play a central role in helping individuals achieve their long-term financial goals. Staying informed about these trends and adapting your investment strategy accordingly can help you stay ahead in the ever-changing world of investing.