Understanding Market Sentiment: The Invisible Force Driving Investments

Market sentiment is the collective attitude of investors toward a particular security or financial market. It is the invisible force that can drive prices up or down, often independent of fundamental factors like earnings or economic data. Understanding market sentiment is crucial for investors because it can provide insights into potential market movements that are not immediately apparent through traditional analysis.

Investors often rely on a variety of tools to gauge market sentiment, including news headlines, social media trends, and sentiment indicators. These tools can help investors identify whether the market is in a state of fear, greed, or indifference. For example, a surge in positive news articles about a particular stock might indicate bullish sentiment, while a spike in negative sentiment on social media could signal bearish sentiment.

However, market sentiment is not always a reliable indicator of future performance. It can be influenced by short-term factors like news events or market rumors, which may not have a lasting impact on a company's fundamentals. As such, investors should use market sentiment as one of many tools in their decision-making process, rather than relying on it exclusively.

The Psychology Behind Market Sentiment: How Emotions Shape Investment Decisions

Market sentiment is deeply rooted in psychology, as it reflects the collective emotions of investors. Emotions like fear, greed, and hope can drive market behavior, often leading to irrational decisions. For instance, during a market bubble, greed can cause investors to overvalue assets, while fear can lead to panic selling during a market crash.

Behavioral finance studies have shown that investors are not always rational. Cognitive biases like confirmation bias, where investors seek out information that confirms their existing beliefs, can distort market sentiment. Similarly, herd behavior, where investors follow the actions of the majority, can amplify market trends, leading to overreactions in either direction.

Understanding the psychological underpinnings of market sentiment can help investors make more informed decisions. By recognizing the role of emotions in market behavior, investors can avoid common pitfalls like buying high and selling low. Instead, they can adopt a more disciplined approach, focusing on long-term fundamentals rather than short-term market fluctuations.

Tools and Indicators for Measuring Market Sentiment

There are several tools and indicators that investors can use to measure market sentiment. One of the most popular is the Volatility Index (VIX), which measures the market's expectation of volatility based on S&P 500 index options. A high VIX indicates increased fear, while a low VIX suggests complacency.

Another useful tool is the put-call ratio, which compares the volume of put options (which bet on a price decline) to call options (which bet on a price increase). A high put-call ratio can indicate bearish sentiment, while a low ratio suggests bullish sentiment. Additionally, sentiment surveys like the American Association of Individual Investors (AAII) Sentiment Survey provide insights into the mood of retail investors.

Social media platforms and news sentiment analysis tools have also become increasingly popular for gauging market sentiment. These tools use natural language processing to analyze the tone of news articles and social media posts, providing real-time insights into investor sentiment. However, it's important to remember that these tools are not infallible and should be used in conjunction with other forms of analysis.

The Impact of Market Sentiment on Asset Prices

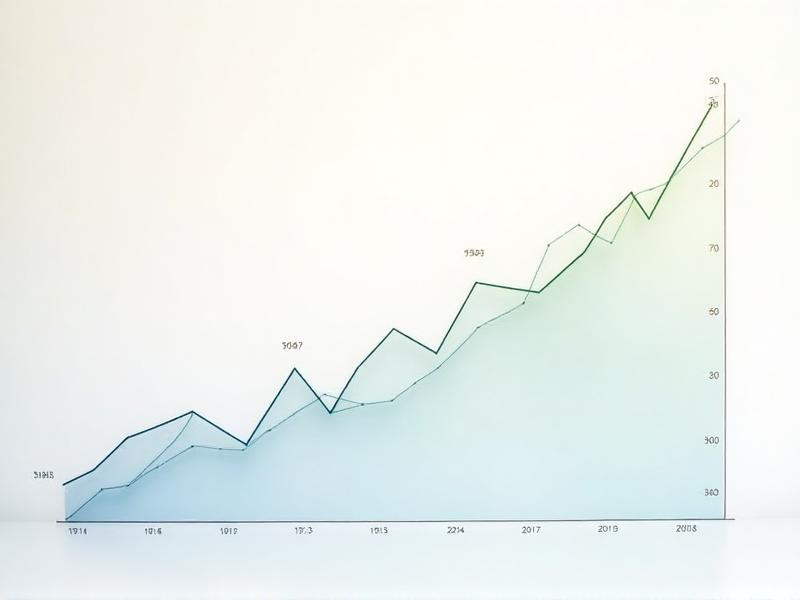

Market sentiment can have a significant impact on asset prices, often driving them away from their intrinsic value. During periods of extreme optimism, asset prices can become overvalued, creating bubbles that eventually burst. Conversely, during periods of extreme pessimism, asset prices can become undervalued, presenting buying opportunities for savvy investors.

One of the most famous examples of market sentiment impacting asset prices is the dot-com bubble of the late 1990s. During this period, excessive optimism about internet companies drove stock prices to unsustainable levels, leading to a massive market correction when the bubble burst. Similarly, the 2008 financial crisis was fueled by widespread pessimism, which caused asset prices to plummet as investors fled the market.

Understanding the impact of market sentiment on asset prices can help investors identify potential risks and opportunities. By recognizing when sentiment is driving prices away from fundamentals, investors can make more informed decisions about when to buy, sell, or hold their investments.

Strategies for Navigating Market Sentiment in Your Investment Decisions

Navigating market sentiment requires a balanced approach that combines both technical and fundamental analysis. One strategy is to use sentiment indicators as a contrarian signal. For example, when sentiment is extremely bullish, it may be a sign that the market is overbought, and a correction could be imminent. Conversely, when sentiment is extremely bearish, it may indicate that the market is oversold, presenting a buying opportunity.

Another strategy is to focus on long-term fundamentals rather than short-term sentiment. By investing in companies with strong fundamentals, investors can weather the ups and downs of market sentiment, ultimately achieving better long-term returns. Diversification is also key, as it can help mitigate the impact of sentiment-driven market fluctuations on your portfolio.

Finally, it's important to stay disciplined and avoid making emotional decisions based on market sentiment. This means sticking to your investment plan, even when the market is volatile, and avoiding the temptation to chase trends or panic sell. By maintaining a long-term perspective, you can navigate market sentiment more effectively and make more informed investment decisions.